Real estate notes offer a compelling avenue for generating passive income. These financial instruments represent the debt owed by borrowers on real estate loans and can provide investors with a steady stream of cash flow through consistent interest payments. By purchasing these notes at a discount, savvy investors can benefit from the difference between the note's purchase price and its face value, creating a potentially substantial return on investment.

- The key to success in real estate note investing lies in meticulous due diligence to select notes with favorable terms and creditworthy borrowers.

- Furthermore, a sound understanding of the real estate market and economic trends is essential for assessing informed investment decisions.

With careful planning and execution, real estate notes can be a effective tool for building wealth and achieving financial independence.

Unlocking Owner-Held Financing for Profitable Deals

Owner-held financing offers a unique avenue for real estate investors to secure profitable deals. This approach allows investors to purchase properties by making monthly payments directly to the seller, rather than relying on traditional lenders. By removing the need for conventional financing, owner-held financing can be a beneficial tool for investors aiming to maximize their returns.

- One of the primary benefits of owner-held financing is that it often comes with more accommodating terms than traditional mortgages. Sellers may be willing to negotiate payment plans that suit the specific needs of the buyer, such as longer repayment periods or lower down payments.

- Additionally, owner-held financing can provide investors with a competitive edge in a hot real estate market. By providing sellers with an alternative investment option, investors can enhance their chances of securing desirable properties.

- Nonetheless, it is important to thoroughly assess the risks and rewards of owner-held financing before entering into an agreement. Investors should execute due diligence on the seller, review the terms of the contract carefully, and obtain legal advice to ensure a win-win outcome.

Overall, mastering owner-held financing can be a valuable skill for investors looking to achieve wealth in the real estate market. By understanding the nuances of this method and implementing it effectively, investors can unlock various opportunities for gain.

Navigating the Note Seller Market: A Guide to Success

Venturing into the note seller market can be a rewarding endeavor, but it's essential to approach it with expertise. Thriving note sellers understand the intricacies of this market and employ read more various methods to maximize their returns. One crucial step is identifying high-quality notes that offer solid investment possibilities. Furthermore, building strong relationships with note buyers is paramount to obtaining profitable deals.

- Studying the existing market trends is essential for spotting lucrative possibilities.

- Bartering effectively with note owners can generate favorable terms.

- Understanding the legal aspects of note selling is essential to mitigate potential issues.

Real Estate Notes: A Powerful Investment Strategy

Gaining entry to the real estate market can be a lucrative endeavor, but traditional methods often require significant upfront capital. Nonetheless, real estate notes present an attractive alternative for investors seeking to leverage property value appreciation without the traditional burdens of ownership. By acquiring a note, you essentially become the lender, receiving regular installments from the borrower and profiting from the interest earned. This strategy can provide a steady stream of passive income and future appreciation as the underlying property increases in value.

- Real estate notes can offer diversification, mitigating risk associated with other asset classes.

- They provide a relatively liquid investment option, allowing for potential resale in the secondary market.

- Due diligence is crucial when evaluating real estate notes, ensuring sound underwriting practices and borrower reliability.

Whether you are a seasoned capitalist or just starting your investment journey, exploring real estate notes can unlock new avenues for financial growth.

Exploring the World of Buying and Selling Mortgage Notes

Embark on a lucrative journey into the realm of real estate investment with mortgage notes. This comprehensive guide will equip you with the expertise to navigate the intricacies of buying and selling mortgage notes, ultimately maximizing your financial returns. From assessing note attributes to negotiating profitable transactions, we'll delve into each crucial aspect. Whether you're a seasoned investor or just starting your real estate portfolio, this guide will illuminate the path to success in the world of mortgage note investing.

- Discover the fundamental principles that govern mortgage note transactions.

- Develop the skills necessary to recognize profitable investment opportunities.

- Understand the art of research to mitigate risk and ensure strategic investments.

- Delve into different note servicing strategies and choose the one that best suits your aspirations.

Revealing Cash Flow Secrets of Real Estate Note Investing

Ready to create passive income through real estate note investing? Dive into the powerful cash flow strategies that savvy investors are using to amplify their returns. We'll delve into the science of note analysis, finding undervalued deals, and effectively managing your portfolio to build consistent cash flow. Get ready to transform your real estate investing game!

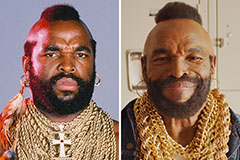

Mr. T Then & Now!

Mr. T Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!